Research Papers

Research publications and working papers from this research agenda are available here. Please send feedback and questions to Scott Stern at sstern@mit.edu and Jorge Guzman at jag2367@columbia.edu.

Overview and Methodology

The Startup Cartography Project: Measuring and Mapping Entrepreneurial Ecosystems

By Raymond J. Andrews, Catherine Fazio, Jorge Guzman, Yupeng Liu, and Scott Stern

2019

Working Paper

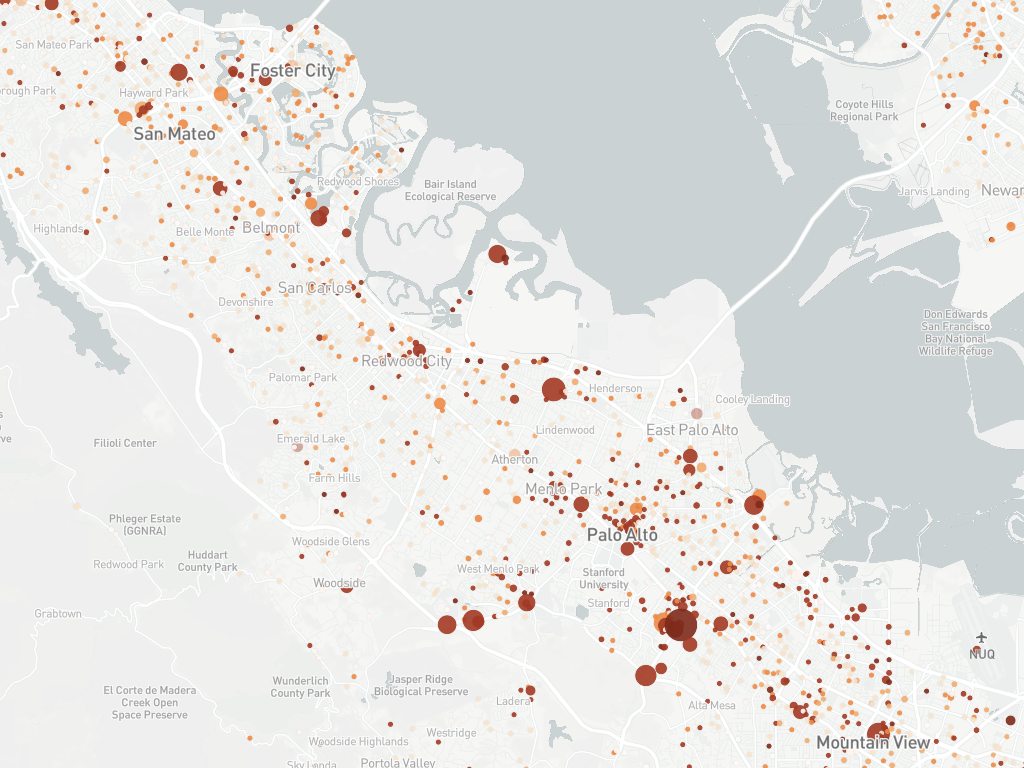

This paper presents the Startup Cartography Project, which offers a new set of entrepreneurial ecosystem statistics for the United States from 1988-2016. The SCP combines state-level business registration records with a predictive analytics approach to estimate the probability of “extreme” growth (IPO or high-value acquisition) at or near the time of founding for all newlyregistered firms in a given year. The results indicate the ability of predictive analytics to identify high-potential start-ups at founding (using a variety of different approaches and measures). The SCP then leverages estimates of entrepreneurial quality to develop four entrepreneurial ecosystem statistics, including the rate of start-up formation, average entrepreneurial quality, the quality-adjusted quantity of entrepreneurship, and entrepreneurial ecosystem performance over time. These statistics offer sharp insight into patterns of regional entrepreneurship, their correlation with regional economic growth and the evolution of entrepreneurial ecosystems over time. The SCP includes both a public-access dataset at the state, MSA, county, and zip code level, as well as an interactive map, the U.S. Startup Map, that allows academic and policy users to assess entrepreneurial ecosystems at an arbitrary level of granularity (from the level of states down to individual street addresses).

Citation: Andrews, Raymond J, Catherine Fazio, Jorge Guzman, Yupeng Liu, and Scott Stern. 2019. “The Startup Cartography Project: Measuring and Mapping Entrepreneurial Ecosystems” Working Paper

Published Research Articles

Where is Silicon Valley?

By Jorge Guzman and Scott Stern

2015

Published in: Science 347(6222): 606–9.

Citation: Guzman, Jorge and Scott Stern. 2015. “Where Is Silicon Valley ?” Science 347(6222): 606–9.

Nowcasting and Placecasting Enterpreneurial Quality and Performance.

By Jorge Guzman and Scott Stern

2017.

Published in: Measuring Entrepreneurial Businesses: Current Knowledge and Challenges. Chapter 2.

A central challenge in the measurement of entrepreneurship is accounting for the wide variation in entrepreneurial quality across firms. This paper develops a new approach for estimating entrepreneurial quality by linking the probability of a growth outcome (e.g., achieving an IPO or a significant acquisition) as a function of start-up characteristics observable at or near the time of initial business registration (e.g., the firm name or filing for a trademark/patent). Our approach allows us to characterize entrepreneurial quality at an arbitrary level of geographic granularity (placecasting) and in advance of observing the ultimate growth outcomes associated with any cohort of start-ups (nowcasting). We implement this approach in Massachusetts from 1988-2014, yielding several key findings. First, consistent with Guzman and Stern (2015), we find that a small number of observable start-up characteristics allow us to distinguish the potential for a significant growth outcome: in an out-of-sample test, more than 75% of growth outcomes occur in the top 5% of our estimated quality distribution. Second, we propose two new economic statistics for the measurement of entrepreneurship: the Entrepreneurship Quality Index (EQI) and the Regional Entrepreneurship Cohort Potential Index (RECPI). We use these indices to offer a novel characterization of changes in entrepreneurial quality across space and time. For example, we are able to document changes in entrepreneurial quality leadership between the Route 128 corridor, Cambridge and Boston, as well as more granular assessments that allow us to distinguish variation in average entrepreneurial quality down to the level of individual addresses. Third, we find a high correlation between an index that depends only on information directly observable from business registration records (and so can be calculated on a real-time basis) with an index that allows for a two-year lag that allows the estimate of entrepreneurial quality to incorporate early milestones such as patent or trademark application or being featured in local newspapers. Finally, we find that the most significant “gap” between our index and the realized growth outcomes of a given cohort seem to be closely related to investment cycles: while the most successful cohort of Massachusetts start-ups was founded in 1995, the year 2000 cohort registered the highest estimated quality.

Citation: Guzman, Jorge, and Scott Stern. 2017. “Nowcasting and Place-casting Entrepreneurial Quality and Performance.” NBER/CRIW Measuring Entrepreneurial Businesses: Current Knowledge and Challenges conference. Eds. John Haltiwanger, Erik Hurst, Javier Miranda, and Antoinette Schoar.

Gender Gap in Entrepreneurship

By Jorge Guzman and Aleksandra (Olenka) Kacperczyk

2019

Published in: Research Policy 48 (7): 1666-1680

Using data on all businesses registered in the state of California and Massachusetts between 1995 and 2011, we examine gender inequality in entrepreneurship. We propose and empirically show that female entrepreneurs are more likely than male entrepreneurs to pursue lower-quality ventures. We also find that female entrepreneurs are less likely than male entrepreneurs to obtain VC funding, even for comparable levels of entrepreneurial quality. Our findings further indicate that the gender disadvantage in entrepreneurship decreases dramatically with increases with entrepreneurial quality. Consistent with the notion of statistical discrimination, we also show that gender disadvantage is amplified for amateur evaluators, more likely to rely on stereotypes when assessing new-venture potential. More generally, the study emphasizes the need to take the distribution of entrepreneurial quality into consideration when examining the mechanisms behind gender gap in entrepreneurship.

Citation: Guzman, Jorge and Aleksandra Kacperczyk. 2019. “Gender Gap in Entrepreneurship”. Research Policy 48 (2019): 1666-1680

The State of American Entrepreneurship: New Estimates of the Quantity and Quality of Entrepreneurship for 32 US States, 1988-2014

By Jorge Guzman and Scott Stern

2020

Published in: American Economic Journal: Economic Policy

Assessing the state of American entrepreneurship requires not simply counting the quantity but also the initial quality of new ventures. Combining comprehensive business registries and predictive analytics, we present estimates of entrepreneurial quantity and quality from 1988-2014. Rather than a secular pattern of declining business dynamism, our quality-adjusted measures follow a cyclical pattern sensitive to economic and capital market conditions. Consistent with the role of investment cycles as a driver of high-growth entrepreneurship, our results highlight the role of economic and institutional conditions as a driver of both initial entrepreneurial quality and the scaling of new ventures over time.

Citation: Guzman, Jorge, and Scott Stern. 2020. “The State of American Entrepreneurship: New Estimates of The Quantity and Quality of Entrepreneurship for 32 US States, 1988-2014.” American Economic Journal: Economic Policy. 12 (4): 212-43

Working Papers

How is COVID Changing the Geography of Entrepreneurship? Evidence from the Startup Cartography Project

By Cathy Fazio, Jorge Guzman, Yupeng Liu, and Scott Stern.

2021

Leveraging data from eight U.S. states from the Startup Cartography Project, this paper provides new insight into the changing nature and geography of entrepreneurship in the wake of the COVID pandemic. Consistent with other data sources, following an initial decline, the overall level of state-level business registrations not only rebounds but increases across all eight states. We focus here on the significant heterogeneity in this dynamic pattern of new firm formation across and within states. Specifically, there are significant differences in the dynamics of new business registrants across neighborhoods in terms of race and socioeconomic status. Areas including a higher proportion of Black residents, and more specifically higher median income Black neighborhoods, are associated with higher growth in startup formation rates between 2019 and 2020. Moreover, these dynamics are reflected in the passage of the major Federal relief packages. Even though legislation such as the CARES Act did not directly support new business formation, the passage and implementation of relief packages was followed by a relative increase in start-up formation rates, particularly in neighborhoods with higher median incomes and a higher proportion of Black residents.

More than an Ivory Tower: The Impact of Research Institutions on the Quantity and Quality of Entrepreneurship

By Valentina Tartari and Scott Stern

2021

This paper provides systematic empirical evidence for the distinctive role of universities and national laboratories on local entrepreneurial ecosystems. Assessing the impact of research institutions on entrepreneurship is challenging, given that these institutions are often located in economic and innovation environments conducive to growth-oriented entrepreneurial activity, are themselves a source of (potentially skill-biased) local demand, and produce knowledge, which might serve as the foundation for new ventures. We overcome this inference challenge in three steps. We first combine comprehensive business registration records with a predictive analytics approach to measure both the quantity and quality-adjusted quantity of entrepreneurship at the zip-code level on an annual basis. Second, we link each location to the presence or absence of research-oriented universities or national laboratories. And, we exploit significant changes over time in Federal commitments to both universities and national laboratories, as well as differences in whether Federal support is directed towards research versus other activities. Combining these building blocks, we find that the presence of a university is associated not only with a higher level of entrepreneurship but also higher level of quality-adjusted entrepreneurship. Second, changes in Federal research commitments to universities are uniquely linked to positively correlated changes in the quality-adjusted quantity of entrepreneurship. In contrast, increases in non-research funding to universities and funding to national laboratories is associated with either a neutral or negative impact on the quality-adjusted quantity of entrepreneurship. Research funding to universities seems to play a unique role in promoting the acceleration of local entrepreneurial ecosystems.

Citation: Tartari, Valentina, and Scott Stern. 2021. “More than an Ivory Tower: The Impact of Research Institutions on the Quantity and Quality of Entrepreneurship” Working Paper

Passive Versus Active Growth: Evidence From Founder Choices And Venture Capital Investment

By Christian Catalini, Jorge Guzman, and Scott Stern

This paper develops a novel approach for assessing the role of passive learning versus a proactive growth orientation in the entrepreneurial growth process. We develop a simple model linking early-stage founder choices, venture capital investment and skewed growth outcomes such as the achievement of an IPO or significant acquisition. Using comprehensive business registration data from 34 US states from 1995-2004, we observe that firms that register in Delaware or obtain intellectual property such as a patent or trademark are far more likely to ultimately realize significant equity growth, and these choices also predict early-stage venture capital investment. Moreover, the estimated probability of receiving venture capital as reflected in early-stage founder choices predicts growth even for firms that do not receive venture capital. We use these findings to estimate bounds on the fraction of proactive versus passive firms among firms that ultimately achieve significant equity growth. While nearly half of all firms that achieve modest equity growth (> $10M) are consistent with passive learning (as they neither make early-stage founder choices nor receive venture capital), 78% of firms experiencing an equity growth event greater than $100M are associated with active founder choices and/or venture capital investment, and these firms are concentrated in geographic hubs such as Silicon Valley. Finally, our approach offers a novel approach for estimating the private returns to venture capital, matching on founder choices rather than demographics; consistent with prior studies, venture-backed firms are approximately 5X more likely to grow, with heterogeneity across location and time period.

Citation: Catalini, Christian, Jorge Guzman and Scott Stern, 2019. "Passive Versus Active Growth: Evidence From Founder Choices And Venture Capital Investment". Working Paper

Go West Young Firm: The Value of Entrepreneurial Migration for Startups and their Founders

By Jorge Guzman

Location is important for firm performance. A new firm choosing a location must trade off the agglomeration benefits of a destination with the loss of local embeddedness from leaving home. I study this tradeoff for a large sample of growth-oriented startups born between 1988 and 2014. I estimate changes in the performance of migrants after migration using both a machine learning approach that accounts for the entrepreneurial quality of firms before moving, and panel data regressions that control for firm and age fixed-effects. The results show migrants improve their performance across a range of outcomes, especially those that move to Silicon Valley. The likelihood of selling the company increases by 4X after migration to Silicon Valley (from 1.4% to 7.1%), and migrants also have higher patenting, commercialization, venture capital financing, and sales. In spite of the important benefits of migration, many potential migrants do not move; a subsample analysis suggests this is due to high personal costs from leaving home that make migration personally unprofitable.

Citation: Guzman, Jorge. 2018. "Go West Young Firm: The Value of Entrepreneurial Migration for Startups and Their Founders". Columbia Business School Working Paper #18-49

Policy Reports

New Business Need a Big Rescue Too.

By Fazio, Catherine, Jorge Guzman, and Scott Stern.

2020

Columbia Business School - the Eugene Lang Entrepreneurship Center.

Citation: Fazio, Catherine, Jorge Guzman, and Scott Stern. Forbes Leadership: “New Business Need a Big Rescue Too.” Forbes.com. Retrieved April 24 2020, from https://www.forbes.com/sites/columbiabusinessschool/2020/04/24/new-business-needs-a-big-rescue-too/#1f52b888309c

A New View of the Skew: Quantitative Estimates of the Quality and Quantity of Entrepreneurship.

By Fazio, Catherine, Jorge Guzman, Fiona Murray, and Scott Stern.

2016

MIT Innovation Initiative. Policy Brief Series.

Citation: Fazio, Catherine, Jorge Guzman, Fiona Murray, and Scott Stern. “A New View of the Skew: Quantitative Estimates of the Quality and Quantity of Entrepreneurship.” MIT Innovation Initiative. Policy Brief Series.

The State of American Entrepreneurship: A Report for the European Central Bank

By Catherine Fazio, Jorge Guzman, and Scott Stern.

2017

MIT Innovation Initiative. Policy Brief WorkingPapers.

Citation: Fazio, Catherine, Jorge Guzman, and Scott Stern. “The State of American Entrepreneurship: A Report for the European Central Bank” MIT Innovation Initiative. Policy Brief Working Papers.